DAX dips further on deflated risk sentiment

The index holds firmly in red for the second straight day and extends 2.45% drop of the previous day (the biggest one-day fall since Oct 28).

Concerns of high valuations of stocks and growing worries about a rise in more contagious variants of coronavirus, soured risk sentiment and pushed stocks lower.

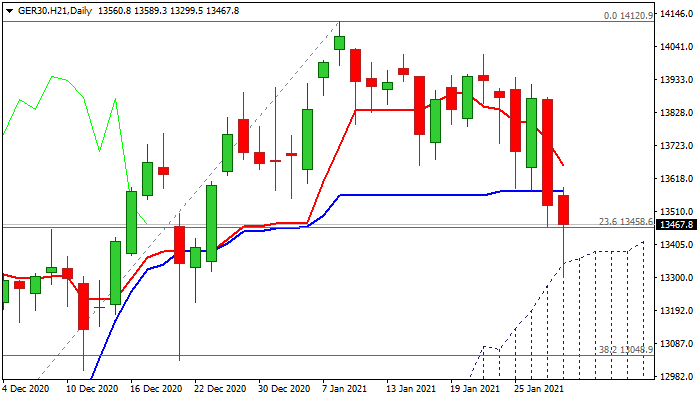

Dax price fell to five-week low on Thursday and dented important support at 13343 (top of ascending thick daily cloud), with today’s close within the cloud to generate fresh negative signal and risk deeper fall towards 13127 (100DMA) and next breakpoint at 13048 (Fibo 38.2% of 11314/14120).

Daily studies turned to negative mode and gaining bearish momentum, however, strong headwinds from thick daily cloud may slow bears.

Consolidation is likely to precede fresh push lower, as additional negative signal has been generated on completion of failure swing pattern on daily chart, while weekly indicators reversed from overbought territories and support the notion.

Upticks are expected to remain below daily Kijun-sen (13576) and maintain fresh bearish bias.

Res: 13576; 13724; 13780; 13822

Sup: 13343; 13299; 13127; 13048