Bulls crack key barriers and shift near-term bias to the upside

The pair rose further on Thursday, extending Wednesday’s 0.45% rally (the biggest one-day gains since Jan 7).

The dollar benefited from fresh weakness of stocks, pressured by concerns about excessive values of stock markets.

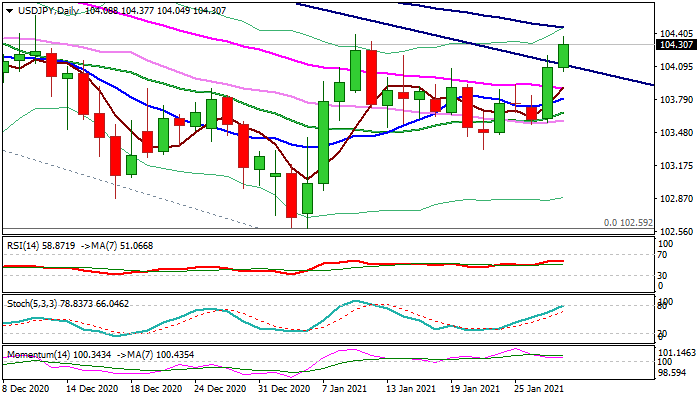

Fresh advance generated initial bullish signal on break of major trendline resistance (104.12) and cracked key barriers at 104.33/39 (top of falling daily cloud / recovery high of Jan 11), with firm break here to signal higher low (103.32) of recovery from 102.59 (Jan 6 low) and shift near-term bias to the upside.

Recovery extension also needs to break obstacles at 104.46 (falling 100DMA) and 104.74 (Fibo 23.6% of 111.71/102.59) to confirm bullish stance.

Broken bear-trendline offers immediate support at 104.10 which should ideally hold and keep intact supports at 103.90 (55DMA) and 103.80 (10DMA).

Res: 104.46; 104.74; 105.00; 105.66

Sup: 104.10; 103.90; 103.80; 103.67