Deeper pullback expected on break of 110 pivot

The pair eases further on Friday following Wednesday’s upside rejection and Thursday’s close in red (the first in seven days) as Japanese traders collected some profits ahead of the weekend.

The dollar came under pressure on fresh risk appetite, driven by optimism for swift US economic recovery, based on upbeat data, new infrastructure investment package and speeding immunization.

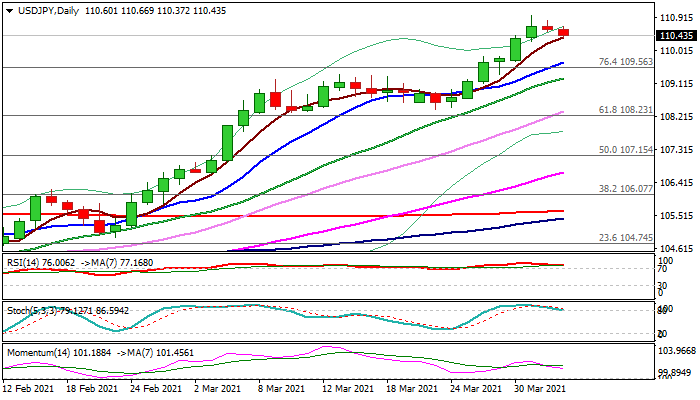

Fading bullish momentum on daily chart and RSI / stochastic on track to reverse from overbought zone, add to negative signals for the US currency.

Fresh weakness cracked initial support at 110.36 (Fibo 23.6% of 108.40/110.96 / 5DMA) that bring in focus more significant 110 support (psychological / Fibo 38.2%), break of which would generate stronger reversal signal and sideline larger bulls for deeper correction

US NFP is forecasted significantly higher from the previous month, with release meeting or exceeding expectations to further boost risk sentiment and increase pressure on the greenback.

Res: 110.66; 110.96; 111.28; 111.71

Sup: 110.36; 110.27; 110.00; 109.68