Dips on sentiment shift stay above 10DMA and keep bullish bias

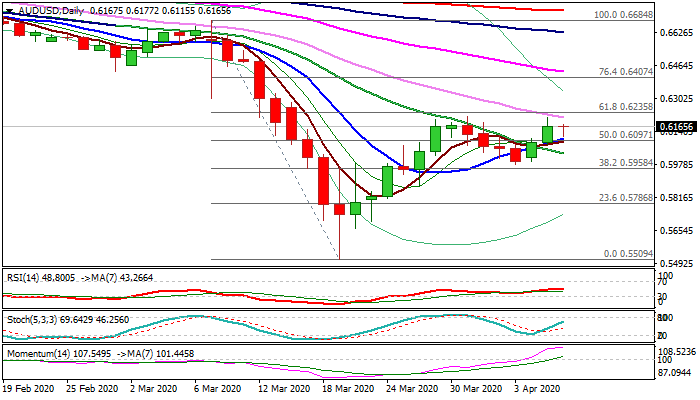

Shift in risk sentiment pushed the Australian dollar lower on Wednesday, but dips were so far limited and stay above rising 10DMA (0.6103), which underpins the action for the second day and marks solid support.

Strong two-day rally from 0.5980 trough has ran out of steam on approach to key barriers at 0.6210/12 (falling 30DMA / 31 Mar high) and 0.6235 (Fibo 61.8% of 0.6648/0.5509 break of which would signal bullish continuation.

Extended consolidation above 10DMA would keep bullish bias for renewed attempt higher.

Conversely, break below 10DMA support would weaken near-term structure and risk test of 20DMA (0.6034).

Res: 0.6177; 0.6212; 0.6235; 0.6281

S up: 0.6103; 0.6095; 0.6034; 0.6000

up: 0.6103; 0.6095; 0.6034; 0.6000