Direction change after weak German data but US-China talks still key driver

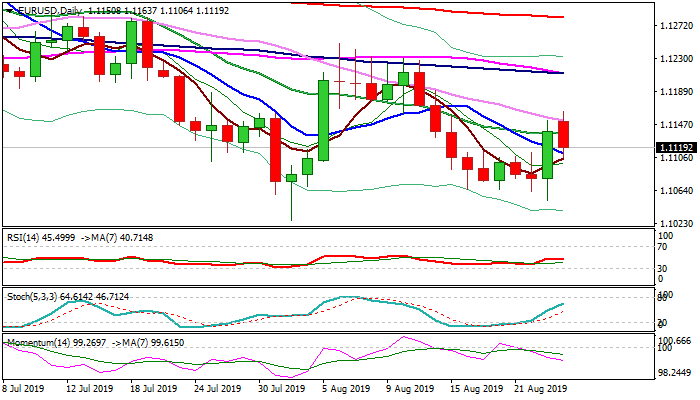

The Euro trades in red on Monday after attempts to extend last Friday’s 0.53% advance failed to clearly break above falling 30DMA (1.1152).

The single currency came under pressure after downbeat German Ifo data (Aug 94.3 vs 95.1 f/c and 95.8 in July) that increased concerns that Germany is heading for recession.

Fresh weakness retraced a good part of Friday’s rally and cracked 10DMA support (1.1110), with close below to generate fresh bearish signal for further weakness.

Rising bearish momentum on daily chart supports the notion, however, the development of US-China trade talks is expected to be the key driver.

Res: 1.1135; 1.1152; 1.1163; 1.1173

Sup: 1.1106; 1.1063; 1.1051; 1.1027