Directionless mode ahead of key events this week

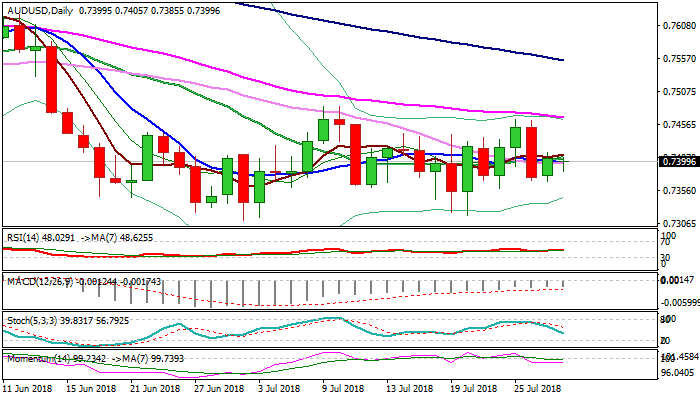

The Australian dollar holds in directionless mode on Monday, unable to extend Friday’s strong recovery rally, as daily techs remain negative and maintain bearish tone.

Overnight’s dip of equities dragged Aussie lower, but the downside looks for now protected.

Plenty of events this week are expected to generate fresh signals, with action starting on Tuesday with Australian housing data, followed by BoJ rate decision and FOMC, which ends its two-day meeting on Wednesday.

Initial pivotal supports lay at 0.7370 (last Thu/Fri lows), loss of which would open way towards key supports at 0.7317/10 (20 / 02 July lows).

Bullish scenario requires close above cracked cluster of daily MA’s (between 0.7396 and 0.7411) which would expose key barriers at 0.7465 (25 / 26 July highs, reinforced by falling 55SMA) and 0.7483/94 (09/10 July highs / daily cloud base).

Res: 0.7411; 0.7440; 0.7464; 0.7483

Sup: 0.7385; 0.7370; 0.7359; 0.7317