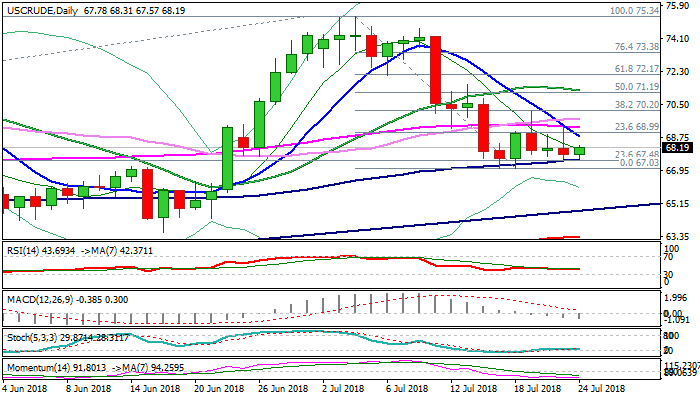

Directionless mode between 100 and 55SMA’s extends

WTI oil price remains in a choppy and directionless mode for the third straight day, on conflicting fundamentals which lack clearer direction signals.

The price rose slightly on Tuesday, keeping temporary base at $67.58, supported by rising daily cloud top, intact for now.

Oil price rose to $69.29 on Monday, driven by though rhetoric of President Trump regarding tensions with Iran, but gains were short-lived as concerns about oversupply prevailed and sent oil price lower.

Tuesday’s bearish daily candle with long upper shadow signaled strong upside rejection and warning about rising pressure, accompanied by weak momentum studies and multiple bear-crosses of falling 10SMA.

Key near-term support, provided by rising 100SMA ($67.51) is under pressure but holds for now and keeps the downside protected.

Break here and below double-bottom at $67.03 would generate bearish signal for continuation of larger downtrend from $75.34.

Conversely, close above falling 10SMA (currently at $68.81) would ease downside risk, but lift and close above 55SMA pivot ($69.30) is needed to generate initial reversal signal.

Res: 68.31; 68.81; 69.30; 70.00

Sup: 67.51; 67.02; 66.36; 64.90