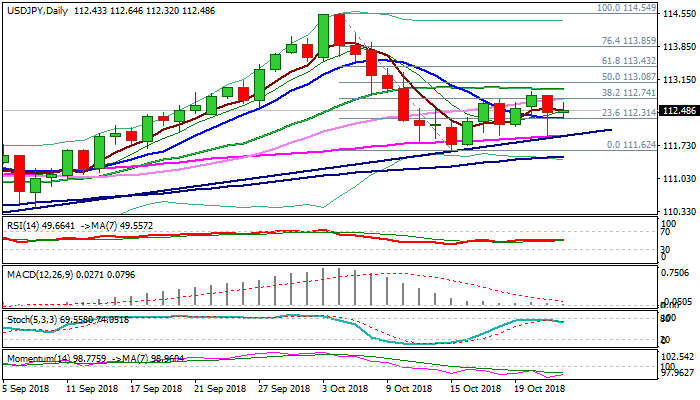

Directionless near-term mode between 10 and 20SMA’s

The pair holds within 30-pips range on Tuesday, supported by 10SMA (112.33) and showing indecision after recovery rally stalled after failure to sustain break above pivotal Fibo barrier at 112.74, but subsequent weakness was strongly rejected at key supports (55SMA / bull-trendline at 111.95).

Mixed daily tech provide no clear signal, with near-term price action holding within thick 4-hr cloud (112.27/78) and cloud borders are reinforced by 10SMA (lower) and 20SMA (upper).

Break of either side would provide initial direction signal, with break higher to open barriers at 113.08 (daily Kijun-sen / Fibo 50% of 114.54/111.62) and 113.43 (Fibo 61.8%).

Negative signal could be expected on break below 10SMA which would risk retest 111.95 pivot and re-expose 111.62 (15 Oct trough).

Res: 112.64; 112.74; 112.92; 113.08

Sup: 112.33; 111.95; 111.62; 111.51