Dollar awaits Fed minutes for fresh direction signal

The US dollar index is in a quiet mode on Wednesday, ahead of release of Fed minutes.

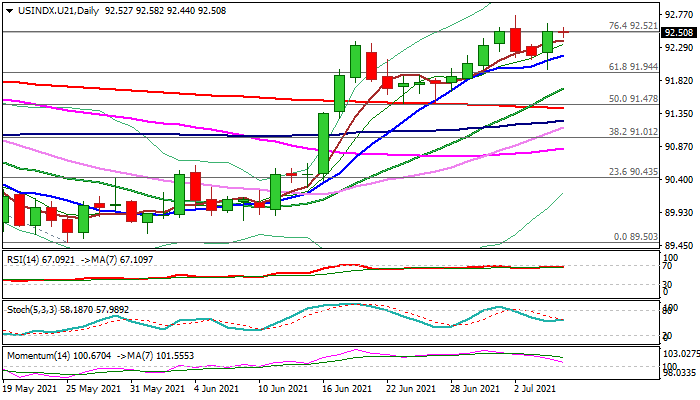

Tuesday’s rebound reversed the most of shallow two-day pullback from new three-month high (92.75), suggesting that near-term bias remains with bulls.

The greenback was deflated on partial profit-taking after solid US jobs data signaled the labor sector remains on recovery track that prompted traders to push the price lower and get better levels to re-enter bullish market.

The minutes of Fed’s June policy meeting are in focus today, as investors expect to get more hints about the timing of any stimulus reduction, as well as information about possible earlier than expected interest rate increase.

Any hawkish shift would be supportive for the greenback, while dovish tone from the US central bank would be dollar-negative.

Daily moving averages remain in full bullish setup, but evident loss of positive momentum warns that bulls might be losing traction.

Rising 10DMA which tracks the ascend for one month, offers solid support at 92.18, followed by broken Fibo 61.8% of 93.45/89.50 at 91.94, with loss of these supports to weaken near-term structure and risk test of 91.50 zone breakpoint (late June higher base / 200DMA), break of which would signal reversal.

Bullish scenario sees eventual close above cracked Fibo 76.4% of 93.45/89.50 fall (92.52) as a trigger for acceleration towards 93.45 (2021 high, posted on Mar 31).

Res: 92.75; 93.00; 93.45; 94.00

Sup: 92.39; 92.18; 91.94; 91.70