Dollar comes under increased pressure on soft US labor data

The dollar fell to the lowest in almost one month, in immediate reaction to weaker than expected US labor data, which revived hopes for two rate cuts by the Fed this year.

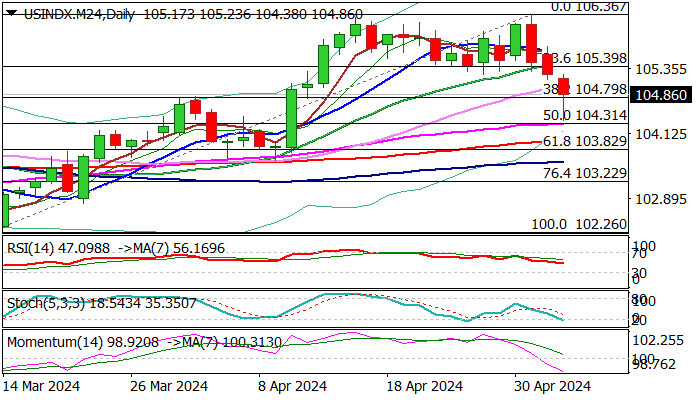

Steep bear-leg extends into third straight day and generated initial signal of a double-top and reversal on daily chart, though signal requires confirmation on today’s close below broken pivotal Fibo support at 104.79 (38.2% of 102.26/106.36 bull-leg.

On the other hand, subsequent bounce from new low (104.38) warns of increased headwinds that bears face from next key support at 104.31 (Fibo 50% / 55DMA) which may keep the price in short consolidation, before resuming lower.

Strong negative momentum and 10/20/30DMA in bearish setup, add to downside prospects, with near-term focus to remain shifted to the downside while the price stays below recent range floor at 105.25.

Res: 105.00; 105.25; 105.40; 105.77

Sup: 104.79; 104.31; 103.99; 103.59