Dollar continues to advance on cooling Fed rate cut bets, Trump election victory expectations

The dollar continues to trend higher against the basket of its major counterparts and trades at the highest since early August during European session on Thursday.

Possibility of election win by Republican candidate Donald Trump and negative impact of recent upbeat US economic data to further Fed rate cut expectations, were the key factors to support dollar.

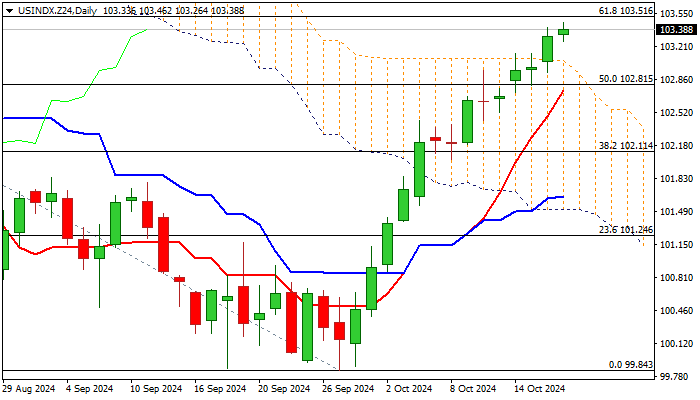

The dollar index is in strong uptrend for the third straight week and has so far retraced over 50% of larger 105.78/99.84 fall.

Recent break above pivotal barriers at 102.95/103.05 (100DMA / top of thick daily cloud) generated strong bullish signals, contributing to bullish daily studies.

Bulls pressure next key barriers at 103.51/56 (Fibo 61.8% / 200DMA) but may face headwinds here due to overbought conditions on daily chart.

Limited dips to be ideally contained by 103.00/102.80 zone (broken 100DMA / cloud top / broken Fibo 50%) to offer better levels to re-enter bullish market.

Release of US weekly jobless claims and September retail sales will be in focus today.

Res: 103.56; 103.80; 104.00; 104.38

Sup: 103.26; 103.00; 102.81; 102.44