EURUSD holds near multi-week low ahead of ECB’s widely expected 0.25% rate cut

The euro fell to the lowest in 2 ½ months in early European trading on Thursday, holding firmly in red for the fourth straight day, a part of larger three-week downtrend.

Markets await the ECB’s policy decision, due later today, with wide expectations that the central bank will deliver the third rate cut this year.

The ECB is likely to cut interest rates by 25 basis points today (Deposit rate to move to 3.25% from 3.50%) as inflation is under control and the economy is stagnating, partially due to high borrowing cost.

Markets also expect the ECB to cut rates three more times until March 2025, though confirmation for such action is unlikely to be heard from President Lagarde and other policymakers, as they stick to their mantra that any policy decision will be based on economic data ahead of every meeting.

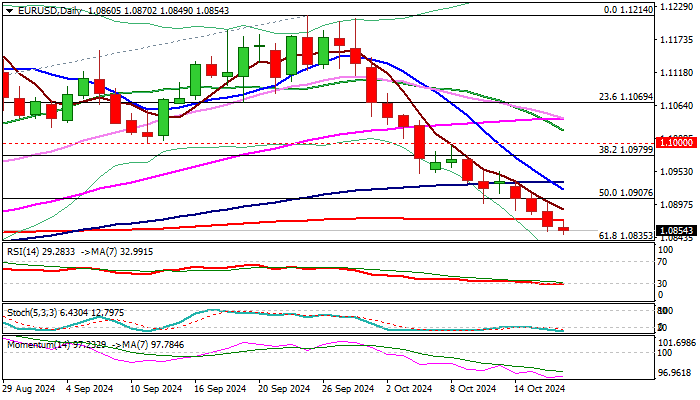

Bearish picture on daily chart (strong negative momentum / Wednesday’s close below 200DMA / 10/100 bear-cross) and weakening weekly studies (14-w momentum indicator is breaking into negative zone / 5/200WMA death cross) support bearish scenario.

Bears eye immediate targets at 1.0835 Fibo 61.8% of 1.0601/1.1214) and 1.0809/00 (weekly cloud base / psychological), ahead of 1.0775 (Aug 1 higher low) and 1.0745 (Fibo 76.4%).

Broken 200DMA reverted to initial resistance (1.0872), followed by falling daily Tenkan-sen (1.0922) and the base of thick daily Ichimoku cloud (1.0968) which should cap corrective upticks to keep larger bears in play.

Res: 1.0872; 1.0907; 1.0935; 1.0968

Sup: 1.0825; 1.0800; 1.0775; 1.0745