Dollar eases from new multi-month high in likely positioning for Fed rate decision

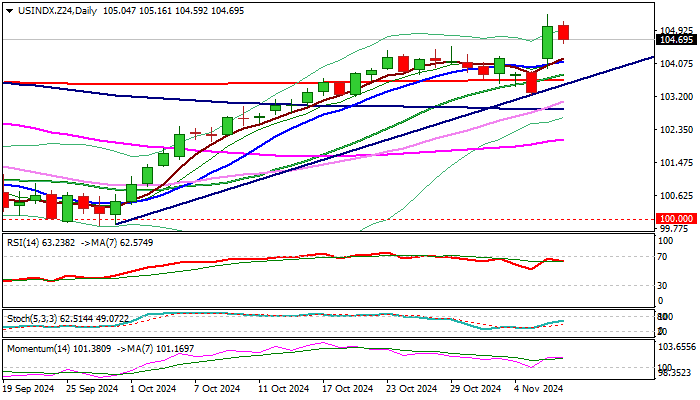

The dollar index eases from new four-month high (105.33) posted on Wednesday’s sharp rally (the biggest daily gain in two years) on news of Trump’s election victory.

Partial profit taking pushed the price lower, but the dollar keeps firm tone (daily studies remain in full bullish setup) suggesting that current dip is just positioning for fresh push higher.

Fed ends its two-day meeting and will announce its rate decision later today, with new situation on monetary policy outlook developing after Donald Trump won the US 2024 presidential election.

Trump’s campaign promises to focus on economy would boost economic growth and subsequently fuel inflation which will need recalibration of Fed’s current rate view.

Market expectations are shifting towards less rate cuts in the near future and earlier than expected end of Fed policy easing cycle, which would add support to the currency.

Solid supports at 104.50/30 (former top / daily Tenkan-sen) should contain dips and keep larger bulls intact for fresh acceleration higher and possible attack at 105.87 (June 28 peak).

Res: 105.33; 105.87; 106.00; 106.36

Sup: 104.50; 104.30; 103.79; 103.64