Dollar edges lower as traders await first results from US election

The dollar dips on Tuesday as traders partially reduce exposure ahead of release of first results from US election.

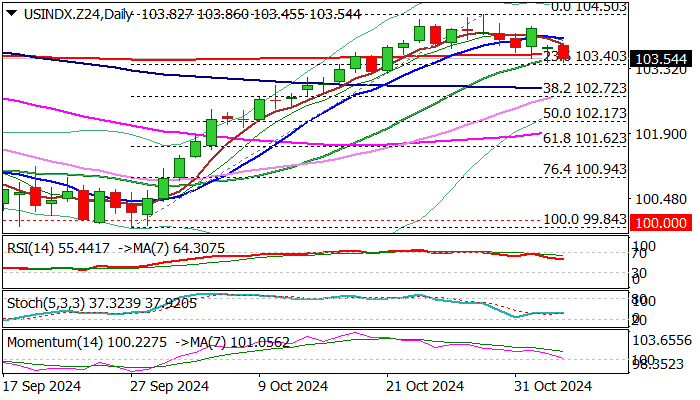

Fresh dip retested Monday’s low (103.45) but faced again headwinds, as bears were so far unable to gain traction, after negative sentiment on Monday’s gap-lower opening, proved to be short-lived so far.

Repeated failure to register a clear break through cracked 200DMA (103.62) would add to signals that larger bulls hold the grip, though the action is likely to remain quiet until the first results from election, which is expected to be the main driver.

Technical studies on daily chart are mixed as dollar continues to lose momentum, but ability to hold above 103.62/40 support zone (converged 20/200 DMA’s on track to form golden cross) would and to broader bullish bias on potential formation of bear trap.

Deeper correction of 99.84/104.50 upleg could be anticipated on close below 103.62/40, with next supports at 102.79/72 (100DMA / Fibo 38.2%) to come in focus.

Conversely, repeated rejection at 200DMA to reduce downside risk, with lift and close above daily Tenkan-sen (103.97) to ease pressure and expose pivotal barriers at 104.25/50).

Res: 103.86; 103.97; 104.25; 104.50

Sup: 103.40; 103.00; 102.72; 102.24