Dollar extends weakness after downbeat ADP data, US services PMI and NFP eyed for more signals

The dollar index fell to one week low on Thursday, extending weakness into second consecutive day, after being pressured by dovish comments from Fed Chair Powell, while weaker than expected ADP private sector payrolls report further soured the sentiment.

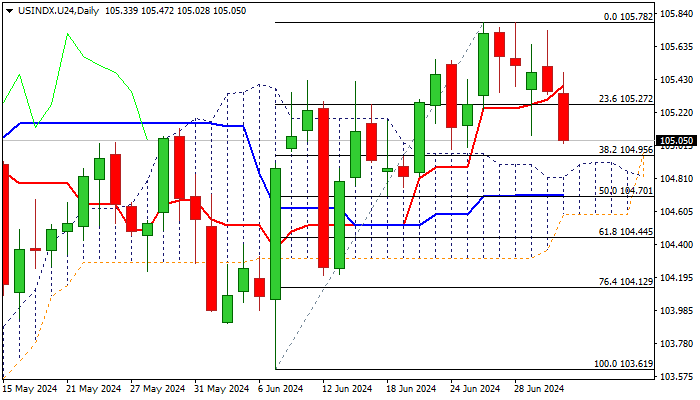

Fresh acceleration lower broke below daily Tenkan-sen and is pressuring pivotal supports at 105.00/104.90 zone (psychological / Fibo 38.2% of 103.61/105.78 / daily cloud top).

Firm break here to generate initial reversal signal and open way for further retracement of 103.61/105.78 rally.

Technical picture is weakening on daily chart and supports scenario, however, increased headwinds likely to be expected at 105 zone.

Markets await release of US services PMI (June 56.7 f/c vs May 58.1) which could further weaken near-term structure on June figure at / below consensus).

US Labor report on Friday will be also closely watched as one of this week’s key economic events.

Res: 105.27; 105.39; 105.50; 105.78

Sup: 105.00; 104.90; 104.70; 104.44