Dollar extends weakness to five-week low and cracks key supports

The US dollar remains firmly in red on Monday, extending a steep fall into third consecutive day and holding around the lowest in five weeks.

The greenback was hit by the latest risk aversion on growing concerns about the crisis in banking sector which prompted investors to migrate into safe havens, such as gold and Japanese yen.

Markets also focus on the outcome of the Fed policy meeting, with growing speculations that the US central bank may keep interest rates unchanged, which would put the greenback under increased pressure, though 25 basis points hike is seen as a likely scenario, with dovish stance expected on rate outlook from Chair Powell, would again have a negative impact on dollar.

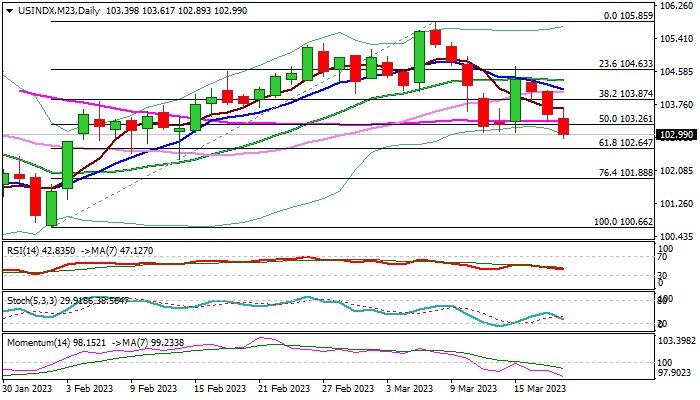

Fresh weakness broke through pivotal Fibo support at 103.28 (50% retracement of 100.70/105.85 / 55DMA) and a higher base at 103.00 zone.

Last Wednesday’s strong rally (the index was up 1% for the day) has been fully reversed, with close below 103 pivot to generate fresh negative signal on confirmation of reversal and completion of failure swing pattern on daily chart.

Bears focus next targets lay at 102.64/24 (Fibo 61.8% / daily cloud base), violation of which would open way for further losses.

Daily moving averages turned to bearish configuration and created a number of bear-crosses, while 14-d momentum remains in a steep descend, deeply in negative territory, contributing to bearish signals.

Res: 103.26; 103.61; 103.87; 104.13

Sup: 102.89; 102.64; 102.24; 101.88