Dollar firms after another failure to clear key Fibo support

The pair jumps back above 107 handle on Thursday as dollar was inflated by unexpected drop in China’s retail sales.

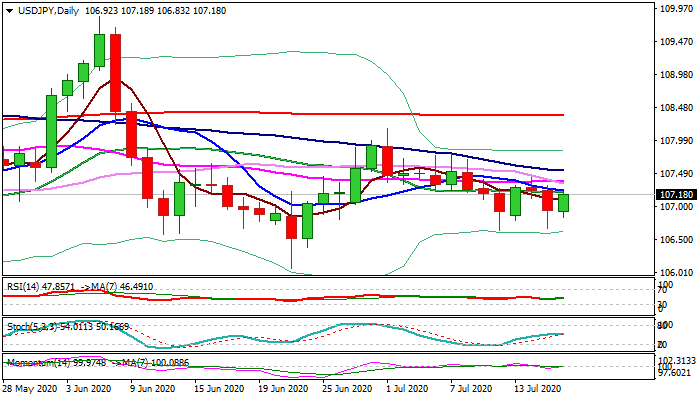

Larger bears continue to face strong headwinds at key Fibo support at 106.87 (61.8% of 106.07/108.16) as several dips failed to register close below the support and warn of bear-trap.

Daily chart shows moving averages in negative configuration and formation of bear-crosses but flat momentum and neutral RSI/stochastic.

Fresh recovery pressure the base of falling thick 4-hr cloud (107.17) and needs close above 107.22 (Fibo 38.2% of 108.16/106.63 / converged 10/20DMA’s) to sideline bears and signal stronger recovery from 106.66/63 double-bottom.

Failure to clear 107.22 pivot would keep the downside vulnerable, but clear break of 106.87 Fibo support is required to signal bearish continuation.

Important US data due today are expected to provide fresh signals for the greenback, with jobless claims expected to fall further but retail sales and Philly Fed Manufacturing Index seen easing.

Res: 107.22; 107.37; 107.53; 107.79

Sup: 107.11; 106.87; 106.63; 106.56