Dollar gains pace on solid data, eyes pivotal barriers

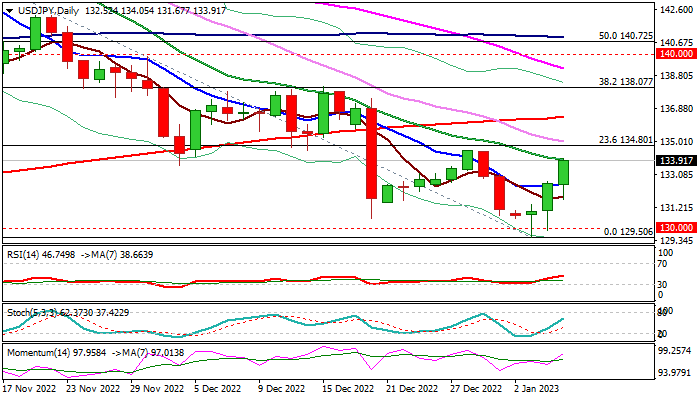

The USDJPY extends strong recovery from a bear-trap under 130 support and advances for the second straight day.

Fresh bulls received additional support from the data which show that US labor market remains tight, adding to scenario of extended period of Fed rate hikes.

Today’s acceleration cracked falling 20DMA (133.98), ahead of pivotal barrier at 134.50 (Dec 28 lower top) break of which add to bullish signals and expose targets at 136.40/138.07 (200DMA / Fibo 38.2% of 151.94/129.50 descend.

Daily techs are mixed, with 14-d momentum still in the negative territory and stochastic heading north, while MA’s are in mixed setup.

The near-term action should stay above 10DMA (132.59) to keep bullish bias.

Investors eye US NFP report on Friday, which would further lift the dollar on better than expected Dec numbers.

Res: 134.50; 134.80; 135.01; 136.40

Sup: 132.59; 131.67; 130.56; 130.00