Dollar index – bears pause for correction, EU inflation and US labor reports eyed for fresh signals

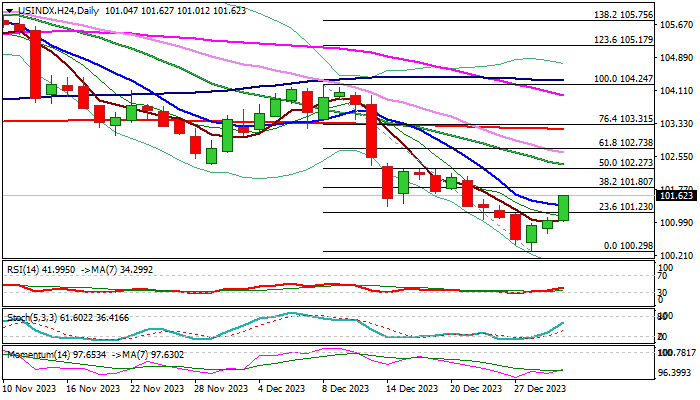

The dollar index accelerated higher on the first trading day in 2024, extending bounce from five-month low of Dec 28 (100.30) into third consecutive day.

Traders collected some profits from the broader downtrend, pushing the dollar’s price higher and sidelining immediate downside threats, as focus shifts to EU inflation data and US labor report, due to be released later this week and expected to provide more clues about next steps of two central banks.

Larger picture shows the dollar index in a downtrend, with current move higher seen as correction which should provide better selling opportunities.

Fresh bulls eye pivotal barrier at 101.80 (Fibo 38.2% of 104.24/100.30), with strong 101.20/30 resistance zone (base of thick weekly Ichimoku cloud / 50% retracement) expected to cap upticks and keep larger bears intact.

Daily technical studies are predominantly bearish (strong negative momentum / MA’s in bearish setup) supporting the notion of limited correction preceding fresh push lower for attack at psychological 100 support and 2023 lows at 99.24/20.

Res: 101.80; 102.20; 102.35; 102.73

Sup: 101.38; 101.23; 100.73; 100.30