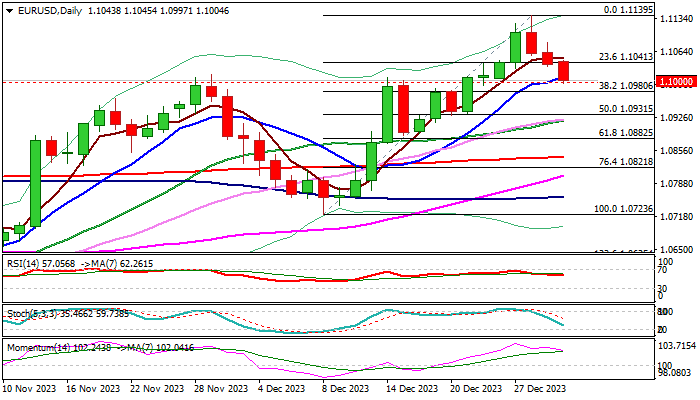

EURUSD – extended pullback is pressuring pivotal supports

EURUSD keeps negative tone in the first trading day of 2024 and extends pullback from a multi-month high (1.1139) into third consecutive day.

Break through initial support at 1.1041 (Fibo 23.6% of 1.0723/1.1139 upleg) extended through rising 10DMA (1.1011) and cracked psychological 1.10 support, which marks the upper boundary of pivotal 1.1000/1.0980 support zone (psychological / Fibo 38.2%).

Deeper pullback could be expected on violation of these levels, as completion of bearish harami pattern on daily chart signaled reversal after a larger uptrend stalled on approach to 200WMA (1.1151) and left weekly inverted hammer candle, adding to negative near-term signals.

Still, the pullback could be seen as a healthy correction of larger uptrend, with solid support at 1.0931 (50% retracement of 1.0723/1.1139 / daily Kijun-sen) expected to contain extended dips and offer better levels to re-join bullish market.

Short-term action is also underpinned by rising thick weekly Ichimoku cloud, with cloud top marking another key support at 1.0910.

Caution on sustained break of 1.0931/10 pivots, which would neutralize larger bulls and open way for stronger correction of 1.0495/1.1139 Oct-Dec uptrend.

Res: 1.1041; 1.1084; 1.1122; 1.1139

Sup: 1.0980; 1.0931; 1.0910; 1.0882