Dollar Index – bulls lose traction but hold grip, as markets await release of US labor data

The dollar index eases from new two-week high on Monday, after strong three-day recovery rally showed initial signs of fatigue.

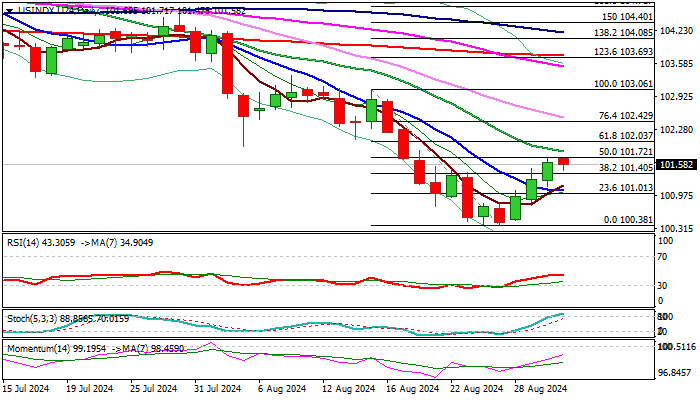

Repeated rejection at 101.72 barrier (50% retracement of 103.06/100.38 bear-leg / 4-hr cloud top) and overbought stochastic contributed to a partial profit-taking, though dips were so far shallow and suggesting that bulls still hold grip.

The dollar was lifted by last week’s inflation data which cooled bets for more aggressive steps by Fed, returning bets to widely expected 25 basis points rate cut.

The pause in rally also comes in days preceding key economic event this week – release of monthly report from the US labor sector, with NFP being particularly in focus.

The latest set of economic data ahead of September’s policy meeting will complete the picture and determine the magnitude of the US central bank’s action.

Expect firmer bearish signal on break and close below broken Fibo barrier at 101.40 (38.2%), with extension below 10DMA (101.07) to confirm reversal.

Conversely, sustained break above pivots at 102.72/85 (50% retracement / 20DMA) to open way for 102+ gains.

Res: 101.72; 101.85; 102.03; 102.43

Sup: 101.40; 101.07; 100.78; 100.38