Dollar index – bulls reduce speed ahead of US inflation data

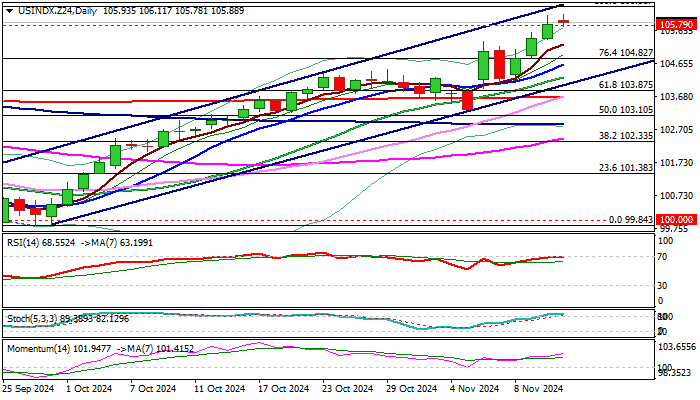

The dollar index keeps firm tone and holding above former top 105.79 but near term action turned to quiet mode in early Wednesday, ahead of key economic event today – US inflation data.

Recent strong bullish acceleration after the dollar was lifted by US election results (so-called Trump trades) has slowed, as markets look for fresh signals from CPI numbers which will subsequently affect Fed’s stance on interest rates.

However, the new reality after Trump’s election victory and anticipated impact of policies he plans to implement, implies that Fed is unlikely to go for initially planned strong policy easing, but will likely look to adjust its action to expected stronger economic growth and elevated inflation.

This sets stage for further dollar’s advance with initial target at 106.36 (May 1 peak) and more significant barriers at 107.00 zone (Oct 2023 lower platform / ceiling of a larger range / 50% retracement of 114.72/99.20 downtrend)., violation of which to signal an end of broader range and open way for stronger gains.

Technical picture is firmly bullish on daily chart positive momentum is strong and MA’s in bullish setup and formed a number of bull-crosses, with price action holding near the upper borderline of a bull-channel (106.41).

However overbought conditions may keep bulls on hold for consolidation, with likely shallow dips to offer better levels to re-enter bullish market.

Former top (105.79) marks immediate support, followed by 5DMA (105.22) and broken Fibo 76.4% level (104.82).

Res: 106.41; 106.96; 107.03; 107.88

Sup: 105.79; 105.22; 104.82; 104.62