Dollar Index – bulls regained traction and eye key barriers

The dollar index firmed on Wednesday and hit week’s high, showing resilience to the latest political turmoil in the US central bank after President Trump decided to fire Governor Cook.

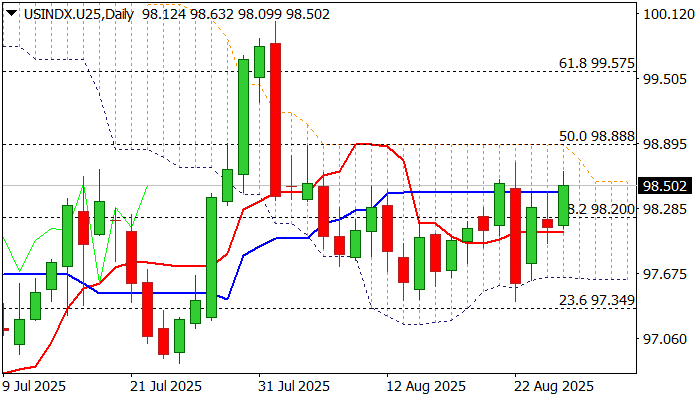

Fresh gains retested falling 100DMA ($98.60), with firm break here and nearby lower top at $98.71 (Aug 22) needed to confirm positive signal and open way for attack at key barrier at $98.88 (daily cloud top / Fibo 50% retracement of $101.80/$95.97 fall).

Technical picture on daily chart has improved as the price rose above converged 10/20DMA’s, while momentum is strengthening (north-heading RSI rose above neutrality territory and 14-d momentum is rising deeper in the positive territory) that supports bullish outlook.

However, failure to clear 100DMA and cloud top would keep the price within current range ($98.71/ $97.58) and without clear near-term direction.

Investors wait for release of US PCE Index (Fed’s important inflation gauge) due on Friday and US July labor report for August (due next week) to get more details about Fed’s action on monetary policy in September’s policy meeting.

Res: 98.60; 98.88; 99.00; 99.57

Sup: 98.20; 98.05; 97.80; 97.62