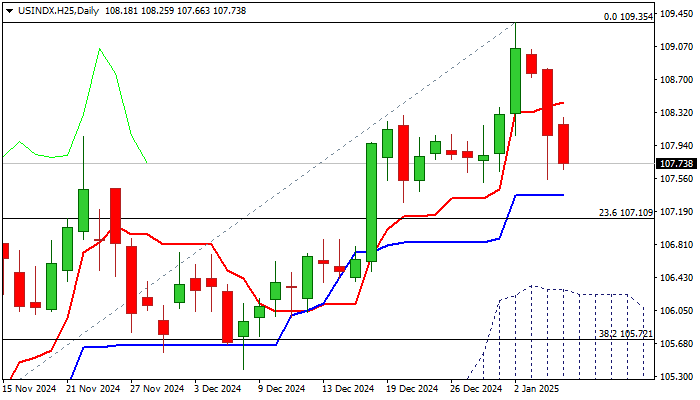

Dollar Index – correction to extend before larger bulls regain control

The dollar index remains in red for the third consecutive day, after a mild easing from a two-year top accelerated on Monday, following a media reports saying that proposed tariffs by Donald Trump may be less aggressive than initially thought.

Although Trump denied the report, the dollar came under fresh pressure after a brief recovery on Monday.

Bears probe again below 107.83 (Fibo 38.2% of 105.37/109.35 bull-leg and eye pivotal support at 107.36 (50% retracement, reinforced by daily Kijun-sen).

The pullback so far looks like a minor correction of larger uptrend from 99.84 (2024 low, posted on Sep 27), indicators on daily chart show more space for deeper pullback, which should be still seen as a healthy correction, before larger bulls regain control.

Daily Kijun-sen should ideally contain, though deeper dips cannot be ruled out, as markets are positioning for Trump’s era, which will be characterized by stronger economic growth and elevated inflation that would likely keep the monetary policy tight and continue to underpin the dollar.

Extended correction should find firm ground at 106.23/105.70 (daily Ichimoku cloud top / Fibo 38.2% of entire rally from 99.84 to 109.35) to keep broader bulls in play and offer better buying opportunities for fresh attempts at psychological 110 barrier.

Res: 108.43; 108.81; 109.35; 110.00

Sup: 107.36; 107.10; 106.70; 106.23