Dollar index falls to three year low as fundamentals deteriorate

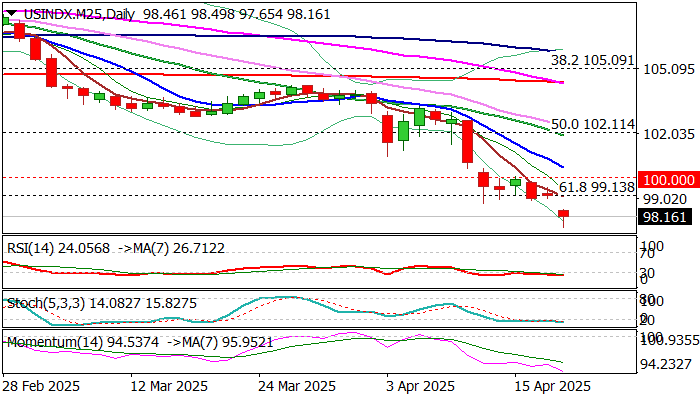

The dollar index remains under increased pressure and trading near new three-year low after it opened with gap-lower at the start of the week.

Turbulent situation on escalation of US-China trade war was fueled by President Trump’s latest criticism of Fed Chair Powel and signals that Powel could be replaced as the central bank does not comply with Trump’s demands to further cut interest rates that would boost economic growth.

Trump’s action produced a massive reaction of the markets, as investors further lost confidence in the US economy, on concerns that potential Powell’s replacement by the President would greatly threat the central bank’s independence.

The dollar remains in a steep downtrend since early February this year, with strong acceleration lower seen in April after Trump announced its latest tariff plan.

Loss of psychological 100 level and likely monthly close below for the first time in three years, contributes to bearish technical picture on all larger timeframes, contributing to negative outlook on deteriorating fundamentals.

Break below the floor of broader range (since 2023) and loss of important Fibo support at 99.13 (61.8% of 89.50/114.72) signals bearish continuation and unmask targets at 97.70 (today’s low / March 2022 higher base) and 95.45 (Fibo 76.4% retracement).

Immediate bias to remain firmly with bears while today’s gap is unfilled, while broken supports at 99.13 and 100 reverted to solid barriers and should cap extended upticks.

Res: 98.77; 99.13; 100.00; 100.45

Sup: 97.70; 95.96; 95.45; 94.60