Dollar index falls to two-month low on ‘buy the rumor-sell the fact’ scenario

The dollar continues to travel south in early Thursday, extending previous day’s 0.63% post-US CPI data drop (the biggest one-day fall since Oct 28).

The dollar came under pressure after Fed Powell’s speech, which investors saw as too cautious, while further disappointment came from Dec CPI numbers coming at forecasted level although inflation rose to the highest in nearly four decades.

Rising price pressures keep the Fed on track towards tightening monetary policy, with the first rate hike expected as early as March and further two-to three hikes to follow, however, cautious tone from Powell and some comments that inflation have peaked in December, discouraged traders and prompted them out of dollar.

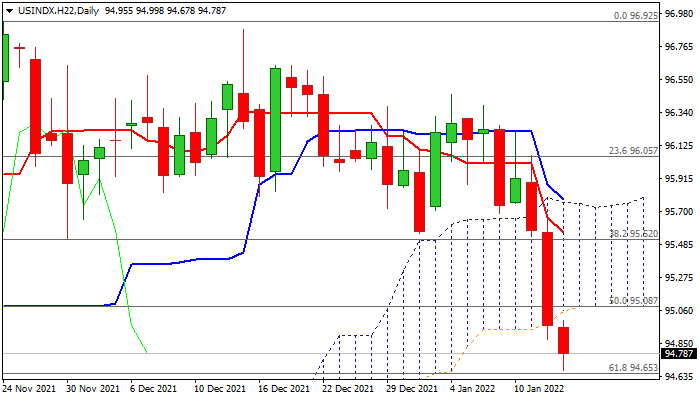

Bears hit two-month low and pressure pivotal Fibo support at 94.65 (61.8% of 93.24/96.92 upleg, reinforced by rising 100DMA) after generating strong bearish signal on Wednesday’s break and close below thick rising daily cloud.

Daily studies maintain strong bearish momentum and MA’s (10/20/30) formed bear-crosses, supporting fresh weakness, which could extend to 94 zone (Fibo 38.2% of 2021 89.50/96.92 uptrend), on break of 94.65 pivot.

Broken daily cloud base (95.08, also broken 50% of 93.24/96.92) reverted to solid resistance, which should ideally keep the upside limited and maintain fresh bears.

Res: 95.08; 95.62; 95.75; 96.05

Sup: 94.65; 94.09; 93.79; 93.24