Dollar index falls to two month low on signals that Fed’s tightening cycle is nearing its end

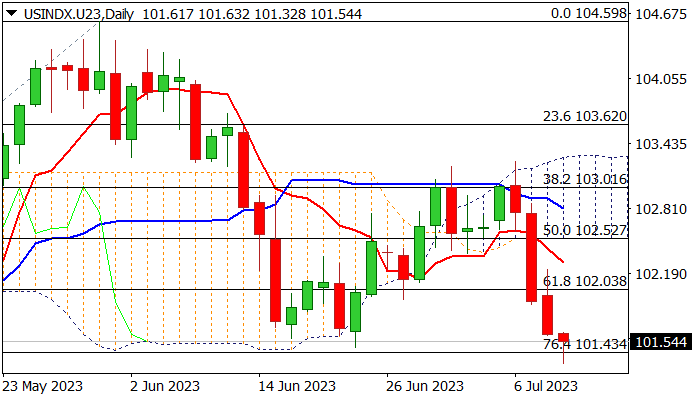

The dollar index hit two-month low on Tuesday, as steep fall off 103.21/25 double-top (Jun 30/July 6) extends into fourth consecutive day and probed below key supports at 101.48/43 (Jun 22 low / Fibo 76.4% of 100.45/104.59 ascend).

The dollar came under increased pressure after the Fed signaled that tightening cycle is nearing its end, although further rate hikes to bring inflation under control, cannot be ruled out.

Markets started to prepare for easier monetary policy, which makes the greenback less attractive, with Wednesday’s US inflation report expected to give more clues about success of strong increase of borrowing cost in past over one year, on the central bank’s fight against stubbornly high inflation.

Further pressure on greenback should be anticipated if June CPI numbers come in line or below expectations.

Bears look for fresh signal on close below 101.48/43 pivots, which would open way for test of a higher base at 100.72 and 2023 low at 100.45 (Apr 14).

Caution on oversold conditions on daily chart which may produce headwinds and keep near-term action on hold for consolidation.

Upticks should stay capped under broken Fibo 61.8% barrier at 102.03, now reverted to resistance, to keep bears in play.

Res: 102.03; 102.30; 102.52; 102.81

Sup: 101.43; 101.00; 100.72; 100.45