Dollar index regains traction and attacking key near-term barriers

The dollar index rose on Wednesday, as greenback regained traction on fresh weakness of index’s major components – Euro and British pound.

Fresh advance fully reversed Tuesday’s dip and generated an initial signal that two-day pullback is likely ending.

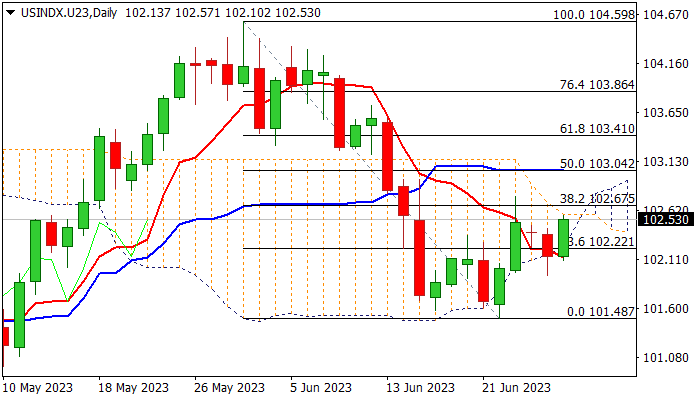

Thinning daily cloud twists on Thursday and attracts fresh bulls, though we need to see a clear break of pivotal barriers at 102.58/67 (cloud top / Fibo 38.2% of 104.59/101.48) to signal bullish continuation of the upleg from 101.48 (Jun 22), which will be confirmed on sustained break above 100DMA (102.81).

Traders await comments from Fed Chair Powell for more clues about the central bank’s action in the near future, as prevailing tone was so far hawkish, but policymakers also need to consider the negative impact of high borrowing to economic growth and recession threats.

Technical signals on daily chart are mixed, with repeated upside failure to keep the downside vulnerable, while sustained break higher would strengthen near-term structure.

Res: 102.81; 103.04; 103.41; 103.72

Sup: 102.40; 101.94; 101.48; 100.99