Dollar index remains constructive ahead of key economic data

The dollar index rose on Tuesday, keeping overall positive sentiment, driven by expectations for Fed rate cut in November and recent political turmoil in the Europe, which deflated Euro.

Traders look for fresh signals about the central bank’s rate cut path, with today’s release of US May retail sales to provide more details about the overall condition of the economy and speeches from several Fed officials, which would give hints about the rate cut timing.

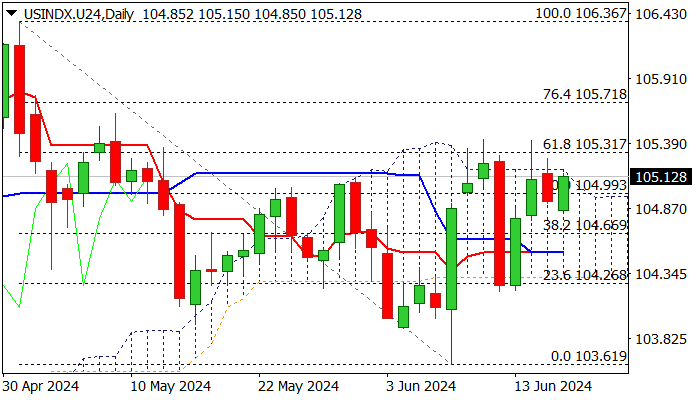

Daily technical studies remain bullish overall, however, near term price action continues to face strong headwinds from the top of daily cloud (15.18) which repeatedly capped attacks and marks solid barrier.

Sustained break here and above recent spikes (105.42) is required to signal bullish continuation and expose targets at 105.71/106.00 (Fibo 76.4% of 106.36/103.61 / round-figure).

Near-term bias to remain with bulls while the price holds above ascending 10DMA (104.77), which guards lower pivots at 104.39/26 (100/200DMA’s / daily cloud base).

Res: 105.18; 105.42; 105.71; 106.00

Sup: 105.00; 104.77; 104.26; 104.04