Dollar index rises to three-month high on upbeat US jobs data

The dollar index rises strongly for the second straight day, after robust US jobs report on Friday signaled that the labor sector remains tight and the economy is in good conditions, which cooled expectations for aggressive rate cuts this year.

The dollar climbed to the highest point in almost three months against the basket of major currencies on Monday, after advancing nearly 1% on Friday and 0.4% until early US session on Monday.

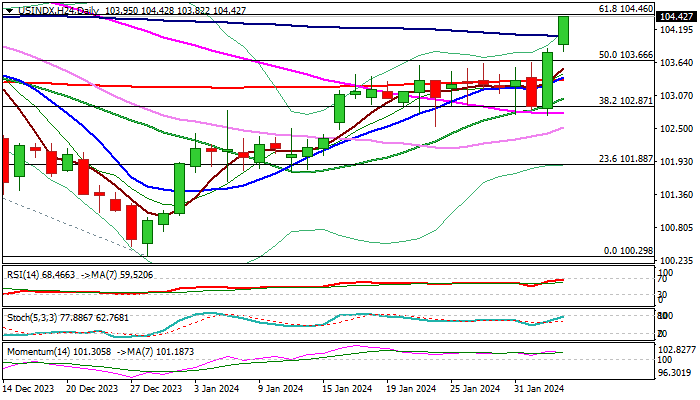

The latest rally also generated a number of bullish signals (Friday’s bullish engulfing pattern, close above 200DMA at 103.37, formation of 10/200DMA golden cross, close above the top of thick daily cloud at 103.63 and break above 100DMA at 104.08) which strongly contribute to bullish near-term outlook.

Bulls pressure pivotal Fibo barrier at 104.46 (61.8% of 107.03/100.29), clear break of which to open way for 105+ extension.

Meanwhile, bulls may take a breather as bullish momentum is fading and RSI is approaching overbought territory, which may prompt traders for partial profit-taking.

Daily cloud top (103.63) and rising Tenkan-sen (103.47) offer solid supports and should ideally contain dips, to provide better buying opportunities.

Recent range floor at 103.80 zone (also broken Fibo 38.2% of 107.03/100.29) marks lower pivot, loss of which will bring bears back to play.

Res: 104.46; 104.66; 105.44; 105.87

Sup: 104.08; 103.87; 103.63; 103.34