Dollar keeps firm tone against its major world counterparts

The dollar index advances for the second consecutive day and hit three-week high on Friday, also on track for the second weekly gain.

Dollar’s bullish stance was boosted by persisting gap in interest rate settings between the Fed and its major peers, as well as strong signals that the US economy remains resilient, which can accommodate extended period of high borrowing cost.

World’s major central banks already made changes to their monetary policies or sent signals that they are on the way to act in the near future, while the Fed left the rates unchanged in the policy meeting this week and repeated their readiness to start easing monetary policy later this year, but repeated that more evidence that inflation is steadily on the way towards 2% target is needed, before making any decision.

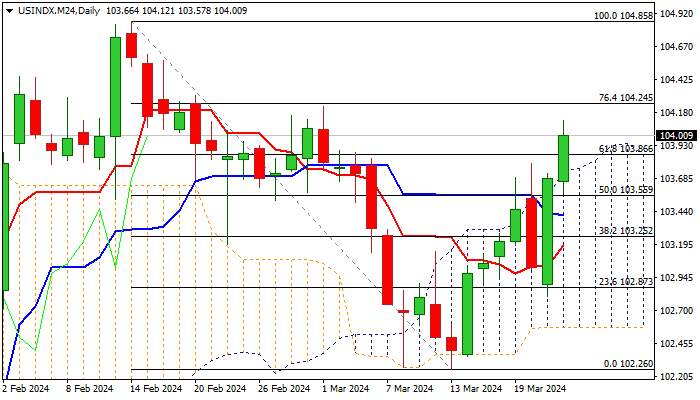

Fresh extension higher generated bullish signals on emerge above the top of daily Ichimoku cloud (103.74) and Fibo 61.8% of 104.85/102.26 (103.86), with close above these levels to confirm signals.

Near-term action is expected to keep bullish bias while holding above daily cloud top

Res: 104.25; 104.56; 104.85; 105.47

Sup: 103.86; 103.74; 103.48; 103.25