Dollar keeps firm tone ahead FOMC rate decision

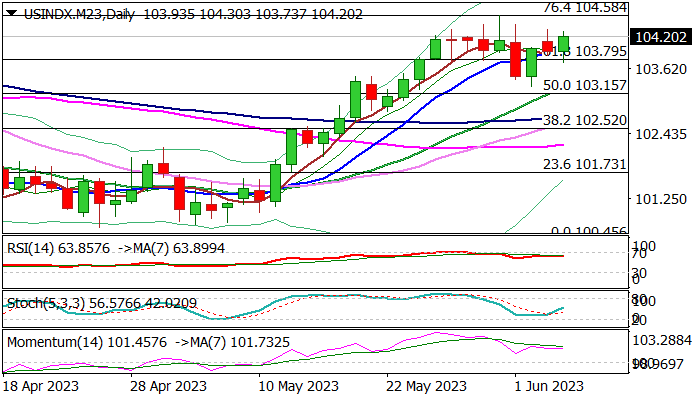

The dollar index regained traction and returned back above 104 mark on Tuesday, on track to fully retrace recent 104.58/103.30 pullback.

The greenback was in a shaky mode in past few days, as increased volatility was sparked by Fed’s rhetoric about policy outlook (pause or continuation of tightening in June meeting), employment and services sector data.

Although hot US payrolls data in May added to expectations for another rate hike, bets that the FOMC will stay on hold in June are growing, but with rising bets for 25 basis points hike in July, keeping the dollar underpinned.

Technical picture on daily chart remains bullish and favoring retest of 2 ½ month high (104.30), also Fibo 76.4% of larger 105.85/100.45 downtrend, break of which would open way for test of key barriers at 105.40/85 (200DMA / 2023 peak, posted on Mar 8).

Broken Fibo 61.8% reverted to solid support which should ideally keep the downside protected and guard lower pivots at 103.30 (rising 20DMA / June 2 low).

Lack of significant US economic data for the rest of the week may keep the action quieter ahead of next week’s key releases – US inflation and Fed policy meeting.

Res: 104.58; 104.70; 105.40; 105.85

Sup: 104.00; 103.79; 103.30; 103.15