Dollar loses traction after private sector jobs data miss; all eyes on NFP and US services PMI

The dollar lost traction on Thursday, after strong recovery in past two days, deflated by disappointing US private sector payrolls data, while a drop below expectations in weekly jobless claims was unable to improve the situation.

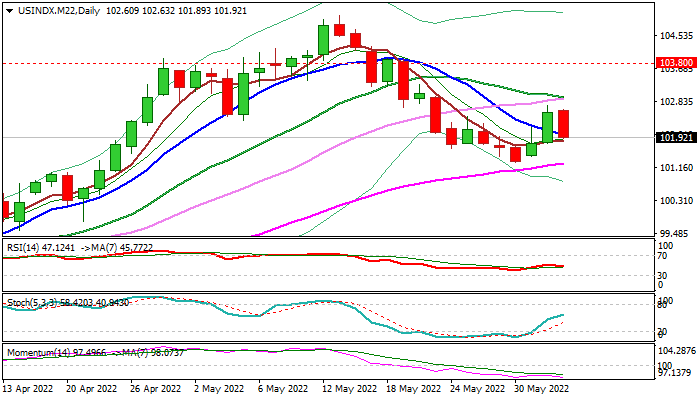

Fresh weakness has retraced the most of Thursday’s 0.75% daily advance and also 50% of entire 101.29/102.73 recovery rally, cracking pivotal 10DMA support (102.00), close below which would weaken near-term structure, as 14-d momentum remains deeply in the negative territory and MA’s (10/20/30) will turn to bearish configuration.

Focus turns towards Friday’s key events – US NFP and Services PMI which are likely to define dollar’s near-term direction, with strong readings needed to lift the currency, while miss would further deflate the greenback and signal an end of near-term correction from 101.29.

Res: 102.18; 102.39; 102.73; 103.00

Sup: 101.63; 101.29; 101.01; 101.52