Dollar remains in defensive on growing expectations for dovish Fed’s policy view

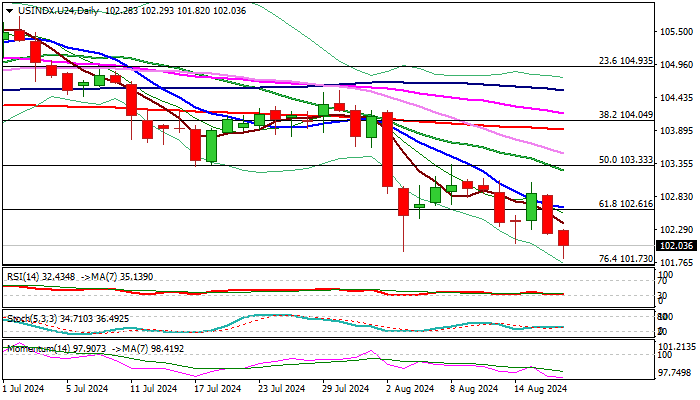

The dollar index remains firmly in red in early Monday trading, and extends Friday’s 0.93% drop, to breach key support at 101.94 (Aug 5 low, the lowest in eight months).

The dollar was weaker across the board on renewed risk mode and growing expectations on more dovish stance by the US central bank on two key events this week- FOMC Minutes on Wednesday and speech of Fed Chair Powell on Jackson Hole symposium of central bankers on Friday.

Traders fully priced in a 25 basis points Fed rate cut in September, while bets for 0.5% cut started to rise again that adds pressure on the US currency.

Firm break of 101.94 pivot to signal continuation of larger downtrend, with violation of nearby Fibo support at 101.73 (76.4% of 100.29/106.36) to confirm the signal and unmask targets at 100.29/00 (Dec 2023 low / psychological).

Falling daily Tenkan-sen / broken Fibo 61.8% offer strong resistance at 102.60 zone, followed by barriers at 103.10 zone (Aug 13/15 double-top) which should cap extended upticks.

Res: 102.39; 102.65; 103.10; 103.33

Sup: 101.82; 101.73; 101.01; 100.29