Dollar remains under pressure on rate outlook

The dollar index remains firmly in red and trading at eleven-week low on Monday, after falling nearly 1.9% last week.

The greenback was sold on fresh signals that the Fed is likely done with rate hikes and may start to ease its monetary policy.

Initial expectations pointed to start of cutting rates in July 2024, though some economists expect the Fed to act earlier, talking about March next year, while the most optimistic forecast see the first rate cuts as early as January.

Signs that the borrowing cost is not going to rise further made the dollar less attractive, with stronger pressure seen on forecasts of earlier than expected start of rate cuts.

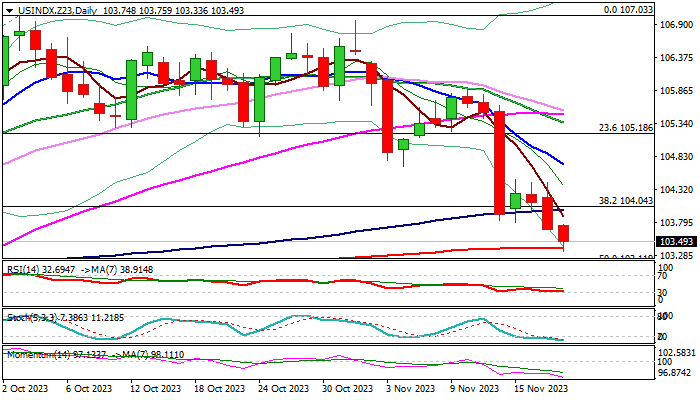

Bears were reinforced by last week’s close below pivotal Fibo support at 104.07 (38.2% of 99.20/107.03 rally) and well below the base of rising thick daily cloud.

Fresh extension lower on Monday cracked 200DMA (103.39) where bears are expected to face headwinds on oversold daily studies, however, the outlook remains increasingly bearish on daily chart, suggesting that limited correction should stay capped under 103.45 (last week’s lower platform) and extended upticks should not exceed falling 10DMA (104.70), to keep bears in play for acceleration through 103.11 (50% retracement) towards 102.19 (Fibo 61.8% of 99.20/107.03).

Res: 103.80; 104.45; 104.70; 105.18

Sup: 103.11; 102.84; 102.19; 101.59