Dollar rises on fading geopolitical fears and solid US PMI data

The pair rises further on Tuesday, extending Monday’s 0.5% rally, boosted by fading fears about escalation of US/Iran conflict and upbeat US Non-Manufacturing PMI data (Dec 55.0 vs 54.5f/c and 53.9 prev).

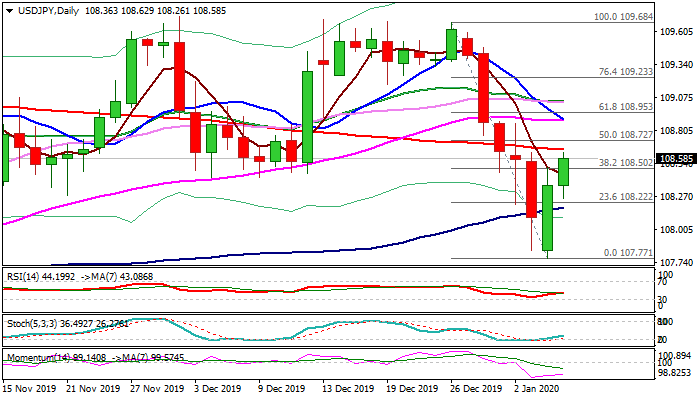

Monday’s short-lived probe below the base of thick daily cloud was short-lived (bears stalled on approach to key Fibo support at 107.71) and subsequent acceleration higher resulted in repeated failure to close below the cloud, generating initial reversal signal.

Fresh bullish extension pressures 200DMA (108.65) break of which would open daily cloud top (108.87) and confirm reversal on firm break higher.

North-heading daily indicators add to positive outlook on improved sentiment.

Broken Fibo 38.2% of 109.68/107.77 (108.50) marks initial support, followed by rising 10DMA (108.18) and cloud base (108.07).

Res: 108.65; 108.84; 108.89; 109.03

Sup: 108.50; 108.18; 108.07; 107.71