Dollar rises to nine-week high on fading risk sentiment

The dollar index extends gains and hits the highest in nine months on Tuesday, lifted by fading risk sentiment on darkening economic outlook on extended lockdowns.

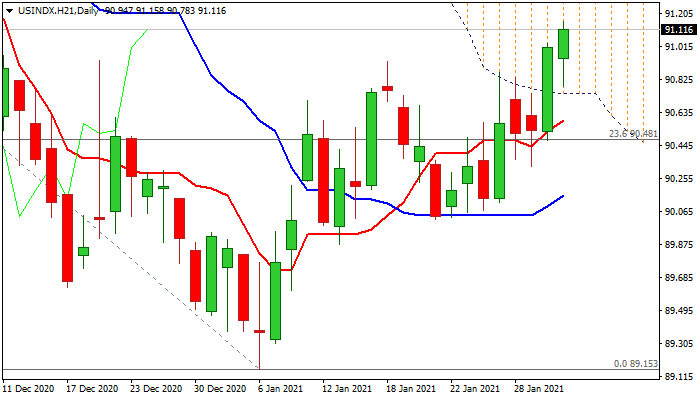

Monday’s 0.54% rally, which penetrated through the base of thick falling daily cloud (spanned between 90.74 and 91.96) and registered close deeply in the cloud, generated bullish signal.

Today’s extension higher (the pair is up 0.2% since opening) eyes next pivotal barrier at 91.30 (Fibo 38.2% of 94.78/89.15 fall), violation of which would add to signals of stronger correction and bring in focus daily cloud top (91.96), also 50% retracement of 94.78/89.15.

Bullish momentum remains strong on daily chart, with formation of 5/55DMA’s bull-cross, underpinning the action, although overbought stochastic warns of headwinds on approach to 91.30 Fibo barrier.

Broken cloud base reverted to strong support (reinforced by 55DMA) which is expected to contain dips and keep fresh bulls in play.

Res: 91.30; 91.48; 91.96; 92.10

Sup: 90.92; 90.74; 90.48; 90.32