Dollar starts to gain traction but remains overall bearish

The dollar index regained some ground on Wednesday following strong drop in past two days, sparked by on calmer tones over recent turbulence in banking sector and growing hopes that deeper crisis can be averted.

Investors remain cautious, as issues in US banks are expected to continue to strongly influence the dollar, with any signals of further calming of the situation or new cracks in the banking system, to spark stronger movements of the US currency.

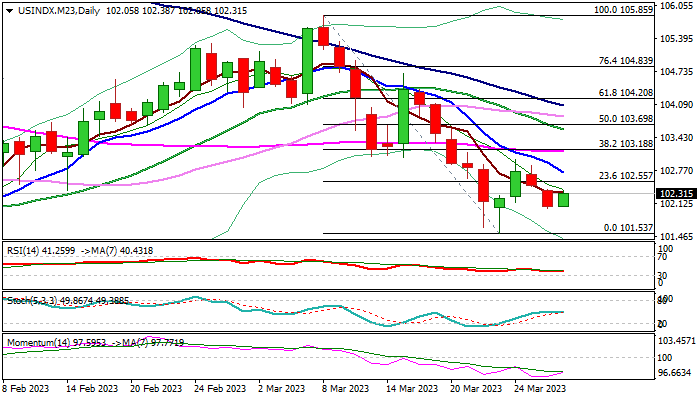

Technical picture on daily chart is still bearish, suggesting that limited recovery is likely to precede fresh push lower.

Initial resistance lays at 102.73 (falling 10DMA) guarding upper pivots at 103.15/18 (55DMA / Fibo 38.2% of 105.85/101.53), which should cap upticks to keep bears in play.

Res: 102.55; 102.73; 103.18; 103.70

Sup: 102.02; 101.88; 101.53; 101.00