Dollar’s recovery likely to be limited

The dollar index lost traction and turned to red in early Monday, after extension of Friday’s recovery quickly ran out of steam, fully reversing initial gains after the index opened with gap-higher on Monday.

Dollar’s performance remains highly dependent on its main counterparts, Euro and British Pound, which turned to bullish mode on renewed risk appetite after tensions in banking sector eased.

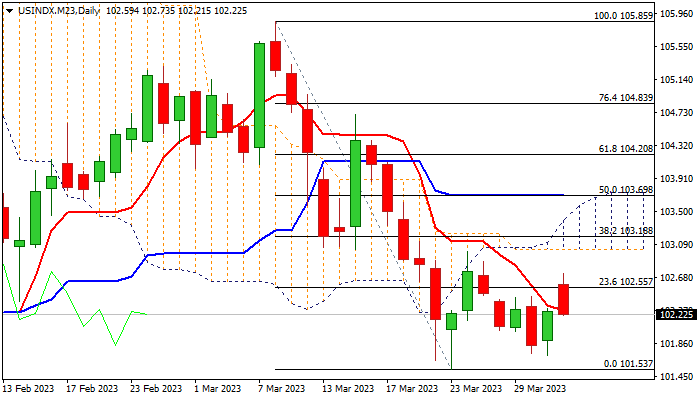

Initial signs of recovery stall on attempts through Fibo barrier at 102.55 (23.6% of 105.85/101.53 fall), reflect still negative technical studies on daily chart, as 14-d momentum remains in bearish mode and thickening daily cloud above the price continues to weigh.

The downside is expected to remain at risk as long as price action stays below 102.55 barrier, while pressure is expected to rise on return and close below daily Tenkan-sen (102.27) and risk retest of pivotal supports at 101.71/53 (lows of Mar 31/23 respectively) which guard key support 100.66 (2023 low of Feb 2).

Initial resistance lays at 102.64, ahead of daily cloud base (103.03).

Res: 102.55; 102.73; 103.03; 103.18

Sup: 102.01; 101.88; 101.71; 101.53