Dovish BoE deflates pound

Cable was sharply down on Thursday (losing almost 1% so far) after BoE’s dovish shift deflated sterling while better than expected US data gave fresh boost to the dollar.

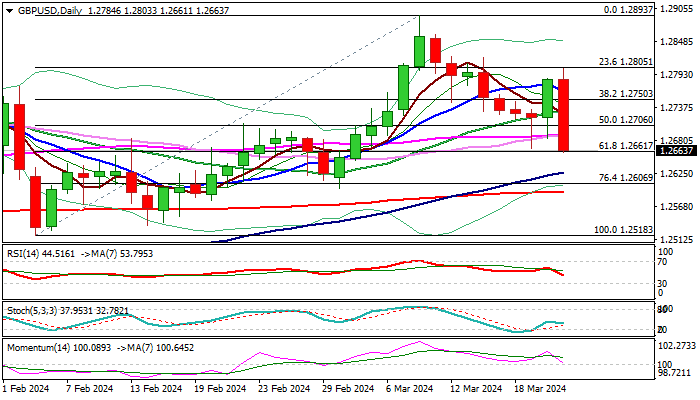

Fresh weakness has fully reversed recovery of past two days and cracked pivotal supports at 1.2667/61 (Mar 19 spike low / Fibo 61.8% of 1.2518/1.2893/ top of thin daily cloud), on track for the biggest daily loss since Oct 12 and completion of bearish engulfing pattern on daily chart, which will add to negative near-term outlook.

Firm break of 1.2667/61 pivots is needed to confirm bearish continuation and open way for extension towards targets at 1.2625/1.2593 (100 / 200DMA’s respectively) and expose key short-term support at 1.2518 (Feb 5 low).

Daily studies are weakening, but still need more evidence of turning to full bearish setup, with upticks required to stay below 1.2700/20 zone to keep fresh bears in play.

More negative signals can be seen on weekly chart as the pair is on track for the second straight weekly loss after the action was repeatedly capped by 200WMA and south-heading 14-w momentum is at the centreline and about to break into negative territory.

Res: 1.2706; 1.2728; 1.2750; 1.2805

Sup: 1.2625; 1.2593; 1.2540; 1.2518