Dow returns to red after Fed action failed to calm markets

The Dow Jones opened lower and hit limit down on Monday, erasing last Friday’s recovery as investors continue to sell after Fed measures failed to restore confidence.

With all sectors being down, sentiment remains weak and risk shifted lower.

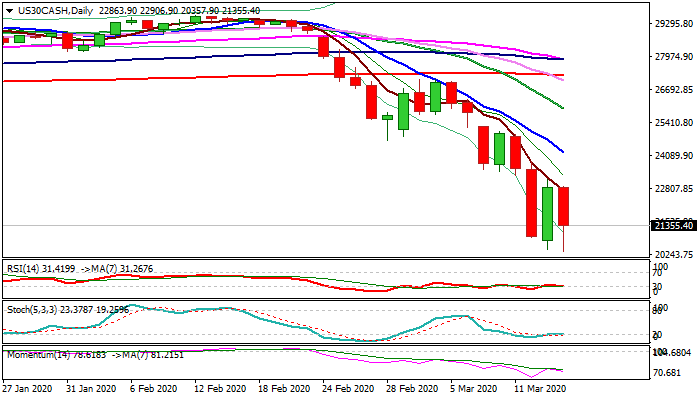

The Dow hit new marginally lower low on Monday (the lowest since early Feb 2017) on renewed probe below important Fibo support at 20846 (61.8% of 15447/29582).

The index fell almost ten full figures in past couple of weeks, following rejection on approach to 30000 level and subsequent weakness that pressures psychological 20000 support.

Firmly bearish daily techs add to negative sentiment in the market, keeping the downside at risk, with eventual close below cracked Fibo support at 20846, needed to confirm bearish stance.

Loss of 20000 handle would spark fresh bearish acceleration and expose Fibo support at 18783 (76.4%).

Res: 21984; 22572; 22906; 23324

Sup: 20357; 20000; 19673; 18783