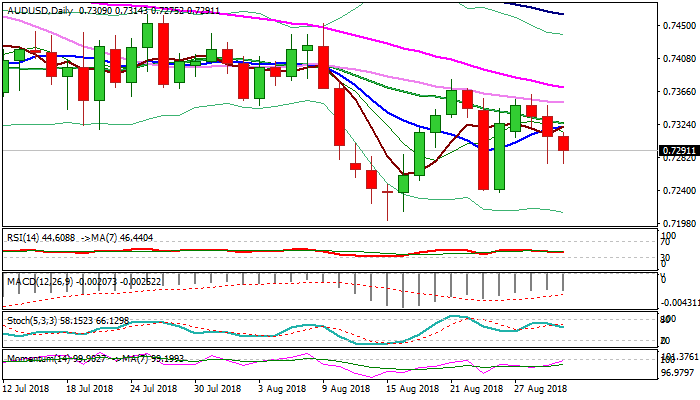

Downbeat data increased pressure but bears lack momentum for extension

The Australian dollar holds in red for the third straight day and pressures Wednesday’s low at 0.7275, where initial dip was strongly rejected.

Series of weaker than expected Australian data, released overnight, keep the Aussie under pressure, as bears look for negative signal on close below cracked pivotal support at 0.7285 (Fibo 61.8% of 0.7237/0.7362 upleg.

Conflicting daily studies (strong momentum vs south-heading slow stochastic and MA’s in bearish setup) may delay bears.

Upticks were so far capped at 0.7300 zone and should stay below falling 20SMA (0.7325) to maintain bearish bias for extension towards 0.7240 higher base.

Close above 20SMA would sideline bears and shift near-term focus higher.

Res: 0.7314; 0.7325; 0.7351; 0.7372

Sup: 0.7285; 0.7275; 0.7238; 0.7202