Downside pressure increases after dovish ECB; thick daily cloud continues to weigh

The Euro entered US session in red and extends losses after dovish comments from ECB’s chief Draghi.

Despite markets expected some hawkish steer, Draghi’s comments on post-rate decision meeting press conference showed no changes from the previous meeting.

Draghi reiterated that interest rates in the Eurozone will remain unchanged until the end of summer 2019 and stressed that the EU economy is still in need for strong stimulus, which would also sideline expectations that the central bank may start winding down the stimulus by the end of this year.

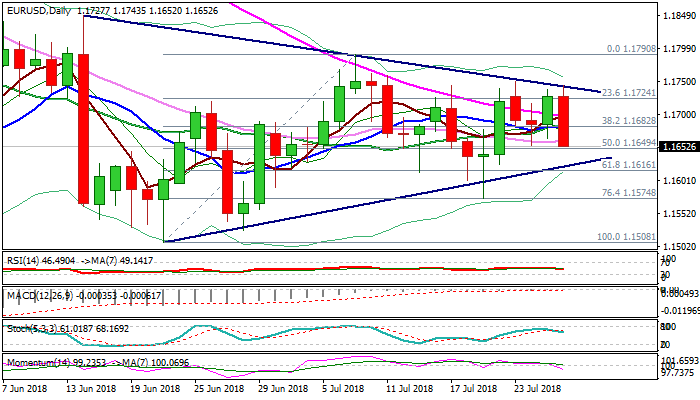

Dovish tone from the central bank head added negative near-term tone after repeated failure to clearly penetrated thick daily cloud, as gains were capped by tringle resistance line (1.1743).

Fresh weakness returned below daily cloud and is on track for strong bearish close today, which could generate bearish signal and risk attack at triangle support line (1.1620).

Close below triangle support line would further weaken near-term structure and risk test of 19 July spike low at 1.1574.

Weakening momentum and a cluster of converged daily MA’s (10;20;30;55) returned to bearish setup, support negative near-term outlook.

Res: 1.1679; 1.1697; 1.1743; 1.1790

Sup: 1.1649; 1.1616; 1.1574; 1.1527