Easing after 5% rally on Friday could be positioning for fresh advance

WTI oil eased from new one-month high at $69.36 and is down around 1% on Monday, as traders took some profits from Friday’s over 5% rally which marks the biggest one-day gains since 30 Nov 2016.

Markets reacted on decision of major world oil producers to start pumping more oil to compensate shortage in global production.

Oil prices rose sharply on Friday as output increase, agreed on OPEC meeting last Friday, was smaller than initially anticipated.

Oil producers also decided to return to their agreement to cut output until the end of 2018, which keeps positive sentiment and supports oil prices.

Also, slight decline in US oil production after four straight weeks of increases, supports the notion, along with bullishly aligned daily studies.

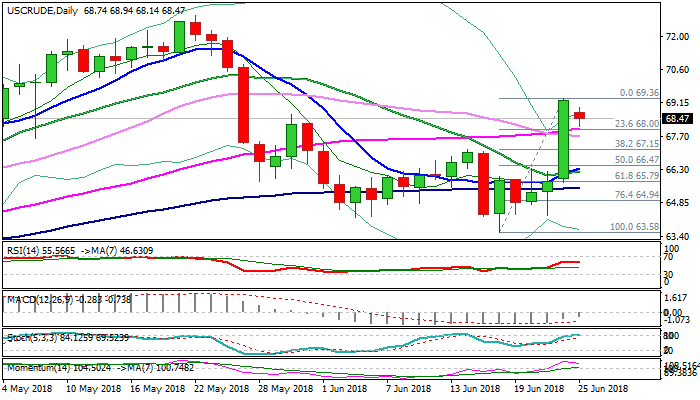

Current easing under key barriers at $69.33 (Fibo 61.8% of $72.89/$63.58 descend) and $69.43 (daily cloud top) could be seen as consolidation before fresh upside.

Eventual break above $69.33/43 pivots, as well as psychological $70 barrier, would generate strong bullish signal for extension of recovery from $63.58 (18 June low).

Sideways-moving daily Kijun-sen ($68.00) holds for now, keeping intact next pivotal support at $67.15 (Fibo 38.2% of $63.58/$69.36 recovery leg), where extended dips should ideally find ground to keep fresh near-term bulls intact.

Break below $67.15 would sideline bulls and risk extension towards next strong support at $66.20 zone, where 10/20SMA bull-cross has formed.

Res: 68.94; 69.43; 70.00; 70.69

Sup: 68.00; 67.70; 67.15; 66.47