EC downgrades outlook and sends Euro lower

The Euro stands at the back foot at the beginning of US trading on Tuesday, as the weakness started in early European session on weaker than expected German data and accelerated after the European Commission in its report, downgraded outlook for the EU and Germany.

With dollar remaining steady from safe-haven buying on the newest tensions in US/China trade dispute, near-term outlook for Euro is negative.

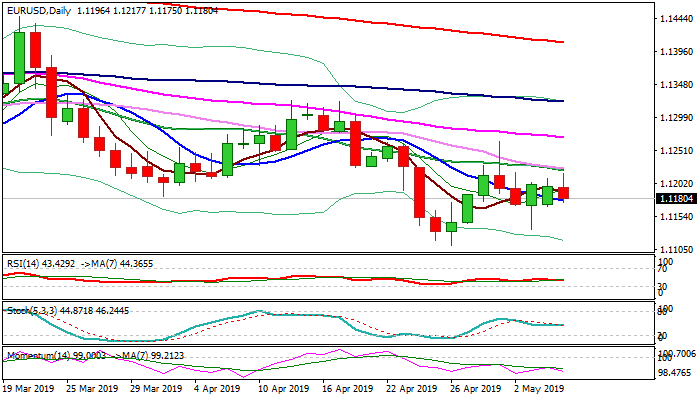

Fresh weakness probes below 10SMA (1.1177) and pressures more significant Fibo support at 1.1170 (61.8% of 1.1111/1.1264) loss of which would generate strong bearish signal and risk further weakness towards 1.1147 (Fibo 76.4%) and 1.1134 (last Friday’s spike low).

Sideways-moving daily Kijun-sen, which repeatedly capped upside attempts, marks pivotal barrier at 1.1217, close above which would sideline downside risk.

Res: 1.1206; 1.1217; 1.1229; 1.1264

Sup: 1.1170; 1.1147; 1.1134; 1.1111