EURCHF bounces from multi-year low on fresh risk appetite / SNB intervention talks

EURCHF edged higher in early trading on Wednesday on s=initial signals that risk appetite is gaining traction.

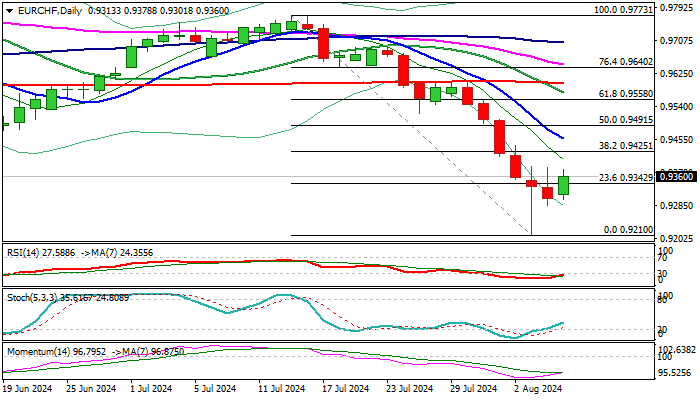

The pair from new multi-year low after being hit by surge in risk aversion in past few days, sparked by worsening economic and geopolitical conditions, which provided strong tailwinds to safe-haven Swiss franc.

Strong bounce from new low at 0.9210 came on likely intervention by Swiss National Bank, aiming to curb strong gains of national currency.

However, recovery still needs to gain pace to generate initial reversal signal, with minimum requirement for close above broken Fibo barrier at 0.9342 (23.6% of 0.9731/0.9210).

The picture on daily chart is negative (double death-cross of 10/200 and 20/200DMA’s / 14-d momentum deeply in negative territory, suggesting that correction may be limited.

Falling 10 DMA (0.9456) and June low (0.9477) mark significant barriers, followed by 0.9490 (50% retracement), with extended upticks to stay below upper pivot at 0.9600 (200DMA) to keep in play prospects for fresh push lower.

Res: 0.9425; 0.9456; 0.9477; 0.9490

Sup: 0.9342; 0.9301; 0.9285; 0.9210