EURGBP accelerates higher on brightening German investor morale and weak UK pay growth data

EURGBP jumped almost 0.4% in European session on Tuesday, as pound came under increased pressure on below forecast UK pay growth data, which further decreased bets for BoE rate hike in Nov 2 policy meeting.

On the other hand, German investor morale (ZEW report – Oct -1.1 vs Sep -11.4 and -9.3 f/c) improved well above expectations, providing strong boost to the single currency.

However, caution is still required as markets do not rule out possible stall of fresh advance, as economic situation in Germany remains fragile and economists expect further decline in inflation, which may negatively impact demand for Euro.

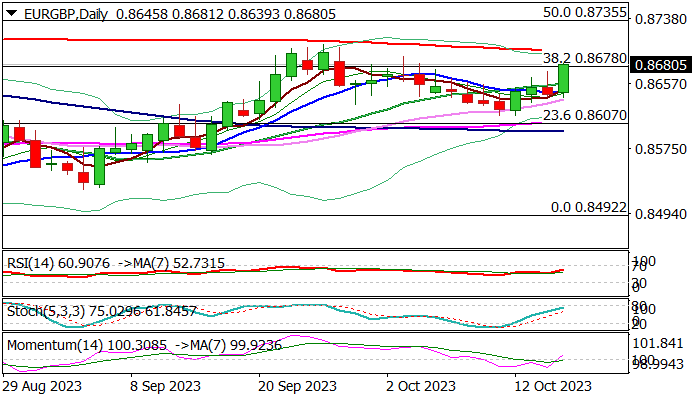

Improving conditions on daily chart (14-momentum broke into positive territory and MA’s turned to bullish setup) underpinning fresh advance, though bulls need clear break above cracked Fibo barrier at 0.8678 (38.2% of 0.8978/0.8492 descend, where recent attacks repeatedly failed to register firm break) to open way towards next key levels at 0.8697 (200 DMA) and 0.8705 (Sep 26 high).

Near-term bias is expected to remain with bulls while the action stays above rising 20DMA (0.8657).

Res: 0.8697; 0.8705; 0.8735; 0.8792

Sup: 0.8657; 0.8639; 0.8616; 0.8607