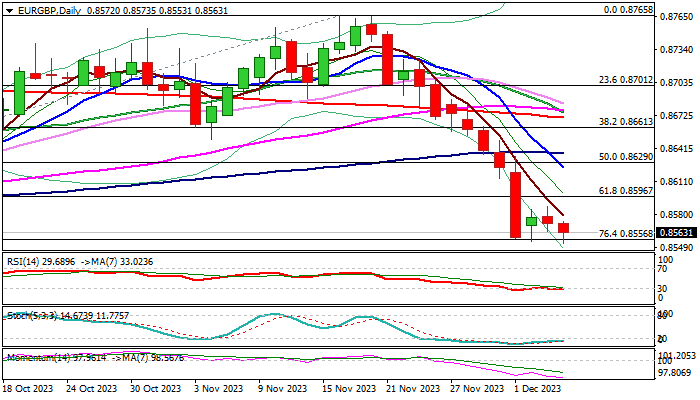

EURGBP hits new multi-month low, but oversold studies continue to obstruct bears

EURGBP fell to three-month low early Wednesday, attempting to resume larger downtrend, after a brief consolidation in past two days.

Larger bears regained traction following a double rejection of recovery attempts and received fresh boost from weak German data (factory orders slumped in October and Nov construction PMI fell to the lowest since mid-2020).

Bears probe again through pivotal Fibo support at 0.8566 (76.4% retracement of 0.8492/0.8765) which contained several attacks in past few sessions, with firm break here to signal bearish continuation and expose targets at 0.8523 (Sep 5 higher low) and 0.8499 (2023 low, posted on Aug 23).

Daily studies are in full bearish setup but oversold, which may produce headwinds and keeps bears further on hold.

Current range top (0.8588) marks initial resistance, followed by broken Fibo 61.8% (0.8596), which should ideally cap upticks and guard upper pivot at 0.8623 (base of thick daily cloud/ falling 10DMA).

Res: 0.8573; 0.8588; 0.8596; 0.8623

Sup: 0.8553; 0.8523; 0.8499; 0.8471