EURGBP slumps ahead of continuation of EU/UK trade talks

The cross accelerated lower on Tuesday (down 0.7% since opening in Asia) and fell to the lowest since 18 June, as pound rose across the board ahead of the latest round of EU/UK talks about post-Brexit trade relations.

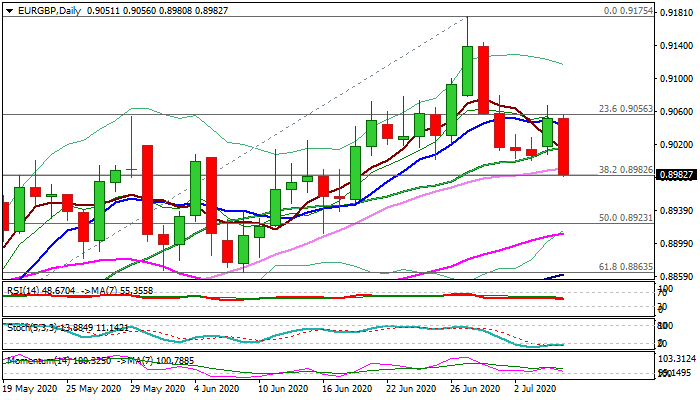

Fresh weakness broke below former low of 03 July at 0.9000, signaling extension of pullback from 0.9175 (29 June peak) on completion of failure swing pattern on daily chart.

The price dropped after brief probe above the top of daily cloud, also attracted by next Monday’s cloud twist.

Bears cracked pivotal Fibo support at 0.8982 (Fibo 38.2% of 0.8670/0.9175), loss of which would risk drop towards 0.8923/11 (50% retracement of 0.8670/0.9175 / daily cloud base).

Fading bullish momentum and 5/10/20DMA’s turned to bearish setup support bears, but oversold stochastic may obstruct the action.

Today’s close below 20DMA is needed to maintain negative bias, while close below 0.8982 Fibo support would confirm bearish stance and signal further weakness.

Res: 0.9016; 0.9044; 0.9067; 0.9080

Sup: 0.8980; 0.8948; 0.8923; 0.8911