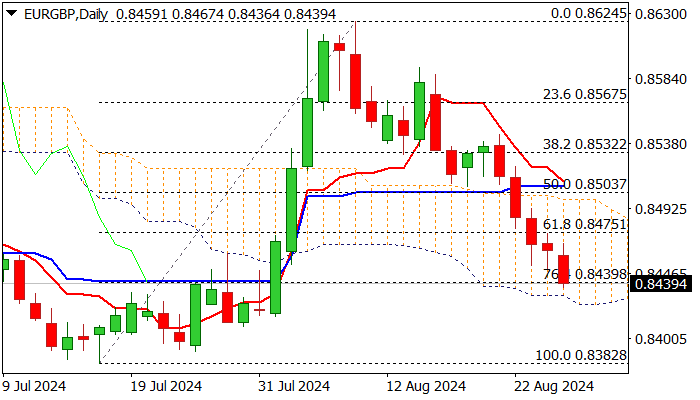

EURGBP – steep bear-leg may take a breather above daily cloud base support

EURGBP cracked Fibo support at 0.8439 (76.4% of 0.8382/0.8624 rally) and pressuring strong support at 0.8424 (base of thick daily cloud) in extension of five-day steep bear-leg off 0.8544 (Aug 21 lower top).

Technical picture on daily chart remains firmly bearish (strong negative momentum / multiple MA’s bear crosses), but oversold conditions and long tails of candlesticks of past two days signal that bears may face increased headwinds on approach to cloud base.

Upticks are likely to be limited and offer better selling opportunities, with initial barrier at 0.8469 (55DMA), followed by more significant 0.8500 zone (daily cloud top / converging 10/100DMA’s on track to form a bear cross / broken 50% retracement), which should cap stronger corrective upticks.

The pair is on track for the second consecutive monthly close below 200MMA, while long upper shadow on monthly candlestick points to strong offer and adds to bearish outlook.

Res: 0.8450; 0.8475; 0.8493; 0.8511

Sup: 0.8424; 0.8400; 0.8382; 0.8339